Get in touch

Contact us to see how we can help your business today.

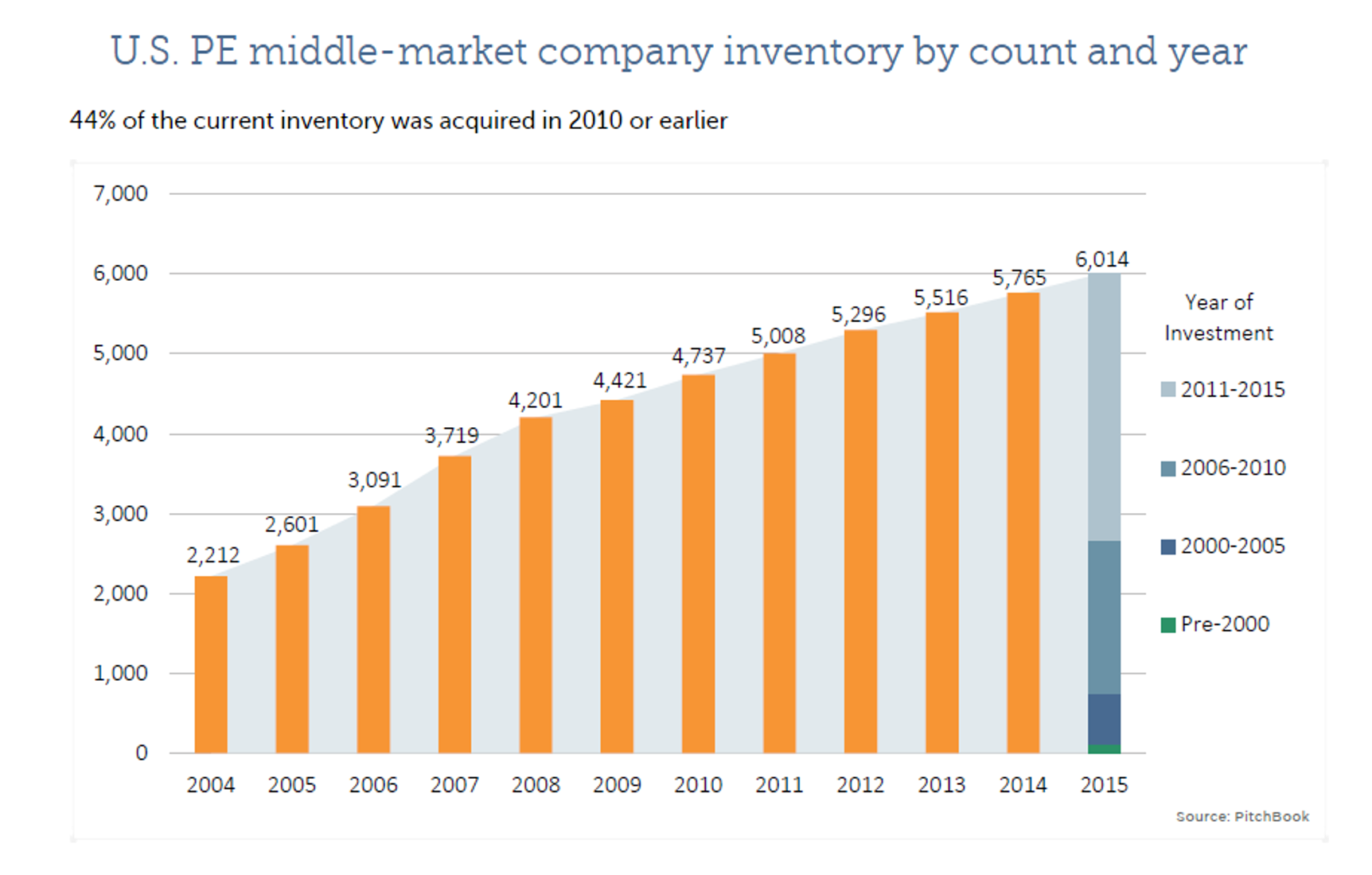

What impact does a longer hold have on value? If holds inherently become lengthened, the potential for a higher return may, in fact, be reduced. Evidence of this proved out in a separate 2015 Pitchbook study. The data shows declines in Private Equity Internal Rates of Return (IRRs) hitting their lowest level since 4Q 2013. The 12.2% IRR across a 5-year horizon was attributed to both aging holdings and a sliding/decline in exit activity.

The fundamental reason behind private equity's historic growth and high rate of return is in its"buy/sell" strategy, according to Harvard Business Review's assessment of private equity vs. public equity. PEs standard practice of buying businesses and then, after steering them through a transition of rapid improvements, selling them, has been key to their success.

In order to guide a business through rapid change, equity managers typically identify businesses that have been underperforming or undervalued at their core. Frequently, by focusing on acute operational improvements, equities have been able to make substantial up-ticks in value quite quickly. But, what if operational improvements are nearly tapped out? What next? Is that the rationale behind the longer holds seen in today's inventory?

To help PEs evaluate and grow portfolio businesses more successfully - and quickly - many of the best practitioners are now turning to other sources of business improvement. In particular, by looking at the business through the lens of customers' perspectives - typically implemented through a Voice of the Customer (VOC) process - PEs are identifying nuanced ways to grow their portfolios faster and better.

A strong customer discovery path looks at the spectrum of intangible assets that, according to S&P, today comprise 84% of a business's value. In the years since PEs have mastered operational improvements, the valuation-scale has now shifted to intangibles - 84% represents an increase of 67% over the same metric tracked in 1975.

Effectual customer insights discovery starts with an in-depth conversation with customers that at its most basic must identify:

VOC work moves beyond "how are we doing" to "what do we need to do?" It sets the stage for rapid growth and improvement. In almost all cases, expect to see as much as 15-20% improvement in a company's performance if there is a consistent Customer Insights initiative, according to S&P profiles. For public entities, that translates to stock value. For private entities that translates directly to bottom-line growth.

The most fundamental strategy for portfolio management: buy low and sell high. And, along the way, leave something of value on the table for the next ownership, too. Not a bad outcome when inventory turns are as important to equity owners as they are to almost every other business model.

Contact us to see how we can help your business today.

Never miss a beat. Get our latest insights in your inbox.