WATCH NOW: Building Customer-Centric Growth Strategies - A Webinar with The American Marketing Association

“Value delivered for the price” is the better way of thinking about what your product should actually cost, versus “This is our price for the product.”

The one sentence never uttered in thousands of customer interviews over the past years for our clients.

With price increases being such a volatile issue, how do you know if your price is right and not causing a loss of business? Or worse yet, what if you're not getting the price your company deserves for what it produces?

Price is determined by two factors: what a customer is willing to pay for it, and what a competitor is willing to sell it for. The former requires delicate research.

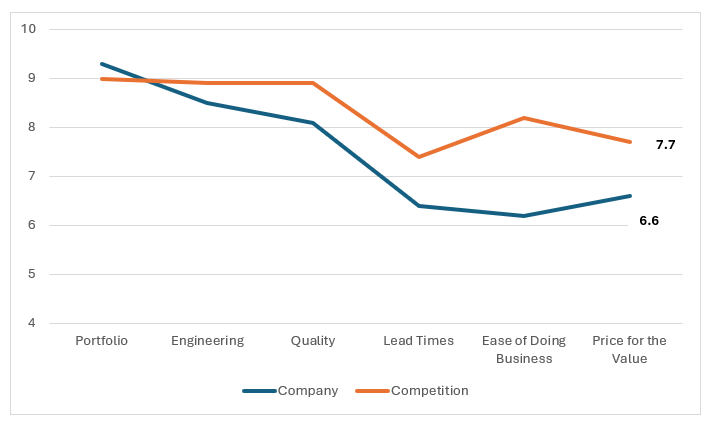

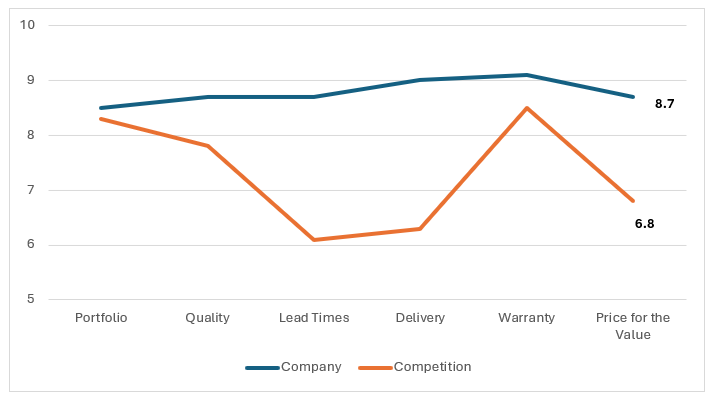

Price elasticity is directly tied to the fundamentals of the business. Think of the fundamentals as the anchor points in your relationship with your customer. The higher the level of performance for any fundamental, the more justifiable the price. To maintain or grow share at a higher price point, your performance in the fundamentals must exceed that of your competitors. Without differentiation, you commoditize yourself, and you cannot compete.

“Value delivered for the price” is the better way of thinking about what your product should actually cost, versus “This is our price for the product.”

Failure to perform at the expected level on any of these five fundamentals will put undue pressure on maintaining the price you want to receive. That said, there should be reasonable price tension in the marketplace. Price tension is the dividing line between what a supplier wants to charge and what a customer is willing to pay. By evaluating how your customers perceive price, we can determine if your price is too high or, more importantly, too low.

Price tension is a valuable data point that helps erode the pervasive notion that lowering prices is the only way to acquire new business.

In our Voice of the Customer studies, we regularly ask participants, "How fair are the prices the company is charging for what they deliver?" If we hear "They're more expensive than their competitors, but they're well worth it because I can sleep at night," we understand there's good price tension. Other responses often include, "I don't have to follow up to see what's going on constantly; they keep me in the loop." That degree of satisfaction and security will usually net a differentiated price of 12-17% above the competition's pricing.

Conversely, if prices are deemed too high, interviewees may say that the product is poorly engineered, not delivered on time, or not delivered in full. They will usually report that they must constantly call to determine the status of their order, or, in general, express frustration and disappointment with the relationship. "If I had any other alternative, I'd leave them in a heartbeat."

What exactly is good price-tension? It’s a data point derived from a representative series of customer interviews, where customers are asked to rate how fair a supplier’s prices are in relation to the value received. On a scale of 1-10, price tension should be 7.4-7.9. If you achieve a score of 8.0 or greater, prices should be strategically raised to capture more revenue. Additionally, if you score 8.6 or above when rating the five fundamentals, and competitors’ ratings are significantly lower than your fundamental ratings, you can selectively increase the price even further.

Price transparency is also a critical part of the conversation. Price transparency reflects a more solid partnership, or at least a desire to create one. When customers use words like "value engineering,” it typically reflects the mindset that they want to see you improve your processes and operations so your company will net more profit – which they expect you to share with them in reduced pricing. Customers want fair pricing, but they understand they need healthy suppliers who can weather unforeseen financial storms without disruption.

If you experience price pressure, ask yourself and, more importantly, ask your customer, "What are we not delivering on that makes our price seem unreasonable? How can we become more indispensable and valuable to you and your company?"

However, if you are fortunate enough to be delivering a high value that customers experience, take a step back. If you consistently meet and often exceed your customers’ needs in terms of quality, application engineering, proactive communication, satisfaction, and deliveries that are on time and in full, then, by all means, strategically raise your prices. You’re doing everything right.

Strategically Raise Prices

8+

On a scale of 1-10, price tension should be 7.4-7.9. If you achieve a score of 8.0 or greater, prices should be strategically raised to capture more revenue.

WATCH NOW: Building Customer-Centric Growth Strategies - A Webinar with The American Marketing Association

WATCH NOW: Building Customer-Centric Growth Strategies - A Webinar with The American Marketing Association

The Evolution of Customer Service to Customer Success

The Evolution of Customer Service to Customer Success

Market-Driven Innovation vs. Technology-Driven Innovation

Market-Driven Innovation vs. Technology-Driven Innovation

Contact us to see how we can help your business today.

Never miss a beat. Get our latest insights in your inbox.