WATCH NOW: Unlock Growth with 80/20

“The oldest and strongest emotion of mankind is fear, and the oldest and strongest kind of fear is fear of the unknown.” – H.P. Lovecraft

The unknown cannot be modeled or projected. Every discovery about it can change our perspectives on how public equities might move or how private companies might be valued.

Heightened systemic uncertainty has shaken the foundations of financial markets. Particularly, the White House’s aggressive stance on tariffs has fueled concerns about the future of the economy and markets.

To gain a balanced perspective of market sentiments, we surveyed thirty key dealmakers at U.S.-based private equity firms.

83% of PE investors that we interviewed agree that tariff concerns have led to more delays in transactions. We have seen this firsthand through our commercial diligence work. The sweeping and volatile nature of the tariff provisions has added considerable complexity to negotiations and due diligence. Supply chain integrity is now a foremost concern for any company that purchases or sells commodities internationally. One concern of particular interest has been around pricing. A common red flag that we look for in customer diligence is a company’s strategy to win and retain customers with low pricing. Companies like this have significantly higher exposure to customer retention risk during macro shocks that drive up pricing, which the White House’s tariffs would deliver in droves.

At the heart of increased transaction delays and challenges is the heightened misalignment on valuations between buyers and sellers. 73% of PE investors share that tariff concerns have led to more misalignment. Intuitively, buyers want as much protection from tariffs as possible, while sellers are loath to give ground on their proceeds due to the ever-changing nature of the White House’s tariff plans. The inherent difficulty of quantifying the potential impact of tariffs will undoubtedly create additional challenges around negotiating representations and warranties, and the corresponding indemnification provisions. While the terms of the upcoming tariffs are uncertain, their financial impact on valuations is unquestionably not. As the trade war intensifies and eases, we expect increased volatility and conflict in PE negotiations.

If anything is to be learned from the dealmaking frenzy in 2021, the key takeaway is that sellers’ valuation expectations are stickier than buyers’ willingness to pay a premium

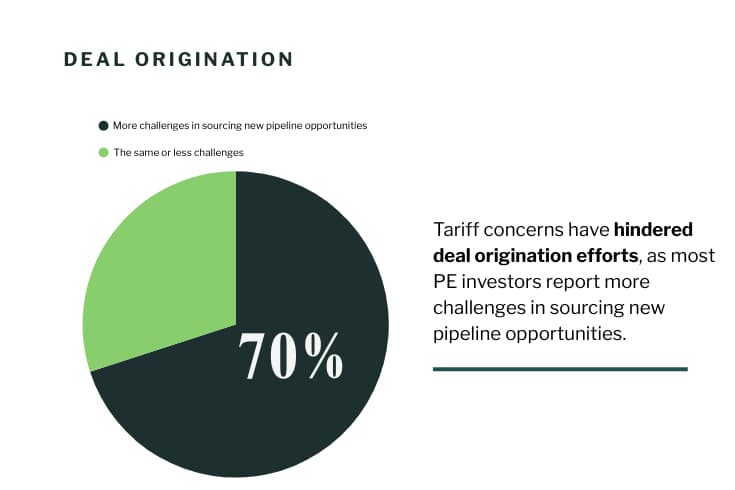

Additionally, tariff concerns have hindered deal origination efforts, as 70% of PE investors report more challenges in sourcing new pipeline opportunities. Several macro uncertainties around tariffs, recession concerns, and interest rates are leading concerns for sellers as they consider their exit. All of these challenges stand to suppress favorable valuations and certainty of closing – the two key gating issues in any reasonable seller’s mind. If anything is to be learned from the dealmaking frenzy in 2021, the key takeaway is that sellers’ valuation expectations are stickier than buyers’ willingness to pay a premium. With continued uncertainties, we anticipate increasing challenges in deal origination as many sellers await more favorable market conditions. Market sentiment reflects this: 43% of surveyed PE investors expect less deal flow throughout 2025 compared to the beginning of the year.

Recession risk significantly influences investor sentiment.

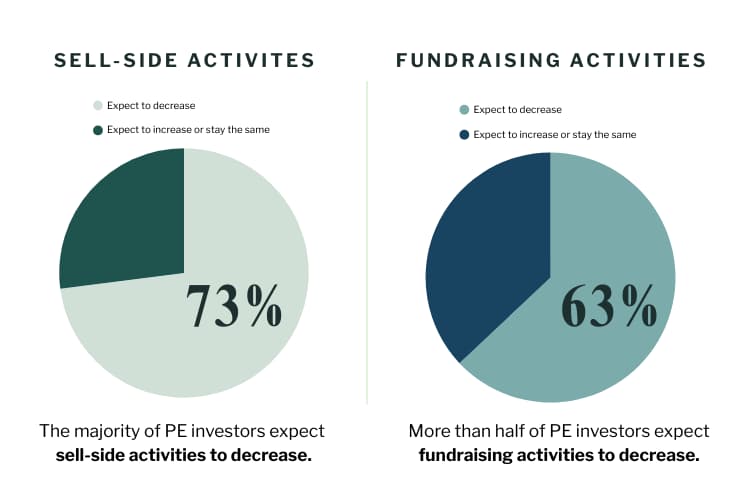

Feedback indicates that a recession would most impact sell-side and fundraising activities. 73% of PE investors expect sell-side activities to decrease, and 63% anticipate fundraising to decrease in response to an economic downturn. Expectations for buy-side activity fared marginally better with 57% foreseeing a decline and 30% showing optimism that a recession may fuel appetite for capital deployment. Savvy investors may view an economic slowdown as an opportunity to purchase underpriced and overly punished assets, potentially achieving higher IRR and ROIC by exiting under more favorable market conditions in the future.

In summary, today’s macroeconomic and policy environment has created hurdles that PE investors must navigate. Investment decisions must be made with greater conviction – and the potential cost could be catastrophic as some buyers may end up acquiring assets with unforeseen liabilities that would destroy IRR and force longer holding periods. However, opportunities certainly exist for investors who can most effectively digest the deluge of macroeconomic uncertainties and know how to create value amidst economic uncertainty.

-

TARIFF CONCERNS DELAY TRANSACTIONS

83%

of PE investors report that tariff concerns have led to more delays in transactions.

WATCH NOW: Unlock Growth with 80/20

WATCH NOW: Unlock Growth with 80/20

Have You Earned the Right to Grow?

Have You Earned the Right to Grow?

Recession Strategy, Part II

Recession Strategy, Part II

Contact us to see how we can help your business today.

Never miss a beat. Get our latest insights in your inbox.