How Private Equity Firms Can Win More Deals and Make Them Count With Smarter Commercial Insights

New research from Strategex suggests that there is plenty of runway for dealmaking in 2025 and beyond, even in the midst of heightened uncertainty and economic concerns.

Pent-up demand for exits, expectations for rate cuts, and optimism for increased productivity from AI solutions… this year had it all.

However, 2025 became an increasingly uncertain environment for making deals. The tone shifted dramatically on April 2nd when the White House announced sweeping tariffs that far exceeded market expectations. Between that and the subsequent fallout (e.g., temporary pauses and legal challenges to the tariffs), our team observed several deals put on hold or outrightly cancelled. The Federal Reserve's cautious stance on monetary policy, citing the White House's fiscal policy, delayed expected rate cuts and reinforced the "wait-and-see" approach that quickly dominated the investment community.

These conversations overlooked a crucial element: the sentiments of business owners. Often disconnected from the pulse of the M&A market, owners tend to have differing expectations and objectives when pursuing a sale. To better understand the sentiments of this critical segment of the M&A sector, our Private Equity Solutions team surveyed 70 business owners in the United States.

More than a third of owners have previously considered a sale. Private equity is perceived as one of the most likely paths to selling ownership stakes.

37% of business owners have considered selling their majority ownership stake at their current organization. Nearly half (48%) of business owners who have previously considered selling their majority ownership stake considered private equity buyers as a potential counterparty. 54% of owners indicated that family members were the least likely mode of exit.

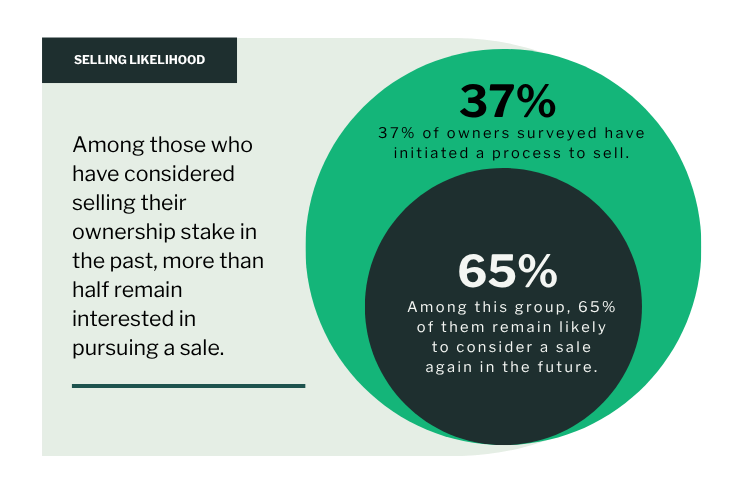

Among those who have considered selling their ownership stake in the past, more than half remain interested in pursuing a sale.

37% of owners have initiated a process to sell their ownership stakes at their current organizations. Among this group, 65% of them remain either “extremely” or “somewhat” likely to consider a potential sale again in the future. Only one business owner who has previously initiated the selling process indicated that they are “extremely unlikely” to reconsider a potential sale. This level of continued interest suggests that this year’s added uncertainties have not dramatically suppressed sellers’ appetite for M&A.

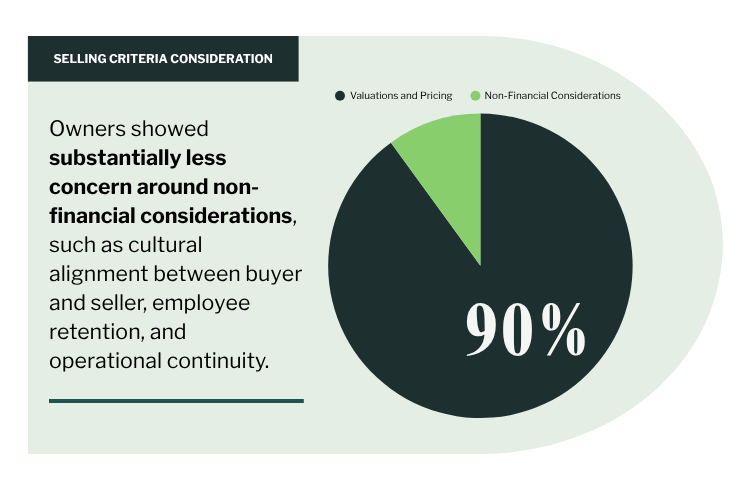

Valuation and pricing, total cash proceeds, and deal structure far outweighed other considerations.

Predictably, the financial deal terms consistently ranked as the most important evaluation criteria for business owners. More than 90% of owners cited “valuation and pricing” as a top-three criterion that is critical to their decision to sell. Owners showed substantially less concern around non-financial considerations, such as cultural alignment between buyer and seller, employee retention, and operational continuity, which all ranked as the bottom-three evaluation criteria.

Multiple expectations are still elevated relative to realistic market levels.

As of June 30, 2025, PitchBook reports TTM EV/EBITDA multiple of 7.9X for B2B M&A across North America and Europe. Business owners’ expectations for the lowest acceptable EV/EBITDA multiple ranged widely, depending on their scale and business type. For example, several owners recognized that their organization's size would influence how the market valued their company (i.e., smaller companies commanding relatively lower premiums, etc.). The average minimally acceptable multiple was ~6.8X across the respondent group, while the ideal valuation was ~10.7X.

After valuation levels ballooned in 2021 due to a hypercompetitive dealmaking environment, seller expectations for exit multiples still appear to remain somewhat elevated. However, the gap between the market level and owner expectations still suggests ample room for dealmaking between two strategically aligned parties.

Most owners are open to the possibility of selling their ownership stake in the future.

66% of owners are “extremely” or “somewhat” likely to consider pursuing a transaction if approached by a potential buyer. Additionally, despite the increased uncertainty in 2025, 77% of owners are either more likely or just as likely to be interested in M&A compared to the end of 2024. Those who are less inclined to be interested most often cite personal considerations rather than sources of uncertainty like the macroeconomy, the policy environment (e.g., tariffs, immigration), and the state of the private equity market.

Nobody has a crystal ball. But sentiments from a sample of business owners suggest that there is plenty of runway for dealmaking in 2025 and beyond, even in the midst of heightened uncertainty and economic concerns. Private equity investors who can navigate the current market environment may have tremendous opportunities to generate value, as history suggests that deals made in challenging economic times can deliver superior returns. As the market gains additional clarity around trade and monetary policies, we expect a sharp recovery in M&A activity as historic levels of dry powder meet business owners with strong interest in capital events.

Contact to Learn MoreContact to Learn More

PE Potential

48%

Nearly half of business owners who have previously considered selling considered private equity buyers as a potential counterparty.

How Private Equity Firms Can Win More Deals and Make Them Count With Smarter Commercial Insights

How Private Equity Firms Can Win More Deals and Make Them Count With Smarter Commercial Insights

Bracing for Uncertainty: The Possible Impact of Tariffs on PE

Bracing for Uncertainty: The Possible Impact of Tariffs on PE

A Coming PE Surge: A Collaboration with PitchBook

A Coming PE Surge: A Collaboration with PitchBook

Contact us to see how we can help your business today.

Never miss a beat. Get our latest insights in your inbox.