How Private Equity Firms Can Win More Deals and Make Them Count With Smarter Commercial Insights

Good customer service isn’t a universal standard. It’s a moving target shaped by what your customers actually value (not just what you think they value). Find out how a structured approach like SERVQUAL helps companies finally get it right.

Ask ten executives what "good customer service" means, and you'll get ten different answers. Fast turnaround. Flawless quality. Cutting-edge products. They're all valid, and that's precisely the problem. When "good" means something different to everyone, how do you build a strategy around it?

The definition of “good” shifts by company, industry, geography, and customer mix. Thus, the real question isn't whether you're delivering good service, but whether your definition of "good" actually matches what your customers value.

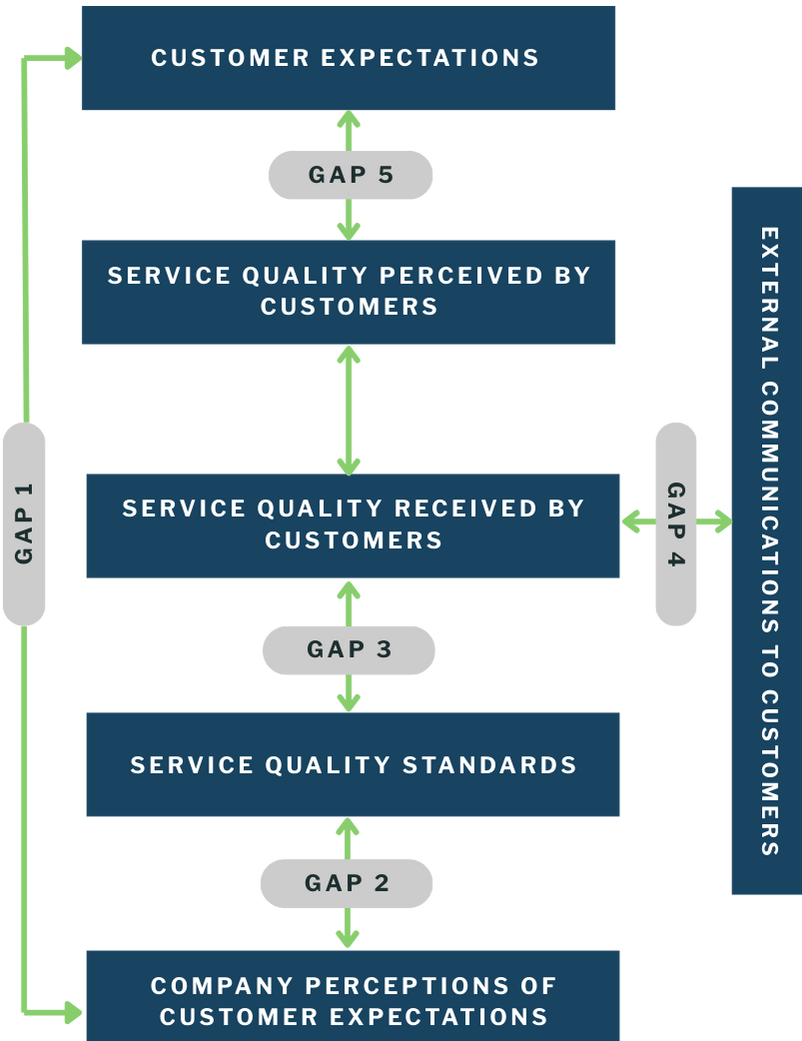

This concept is appealing because it's intuitive; nearly everyone has experienced this gap as a consumer. And it's measurable: thorough customer analysis can identify both explicit and implicit needs, then compare them against what's actually delivered. But here's the problem: measuring the gap doesn't tell you why it exists. Analyzing this gap often does not allow companies to effectively diagnose where the service delivery model may fall short of customer expectations. Based on our experience leading hundreds of customer due diligence and customer insights engagements, breaking down a company’s customer service capabilities provides a higher degree of structure and actionability for management teams. The model of service quality – also known as SERVQUAL – effectively breaks down an organization’s service delivery system into five distinct components, which helps identify specific performance shortcomings (or “gaps”) and the necessary improvements to address them.

A few years ago, our Private Equity Solutions team led a customer diligence engagement for a lower-middle-market healthcare software company (hereby referred to as “TargetCo”) specializing in clinic management. Management’s perspective on customer needs and the company’s ability to deliver value differed substantially from customer expectations. As a result, the company exhibited poor customer loyalty and systemic shortcomings in the customer experience. This case study is a perfect demonstration of SERVQUAL.

Gap I: Knowledge – Actual customer expectations vs. management’s understanding of customer expectations

TargetCo’s management strongly believed that introducing new features and product innovations was critical to the company’s value proposition. Management set TargetCo's strategic direction without input from the customer-facing employees who actually developed and implemented the software. As a result, much of the team spent their time exploring new functionalities rather than addressing customer needs. Simultaneously, customer feedback indicated that the core software lacked several fundamental capabilities, including basic reporting, user training, and medical records management. Because of these pain points, customers couldn't realize the software's full potential and became resistant to adopting new product innovations. We most often see such shortcomings in companies that lack customer research or feedback mechanisms. Frequently, management will insist that they talk to their customers daily. However, our research often shows that communication frequency does not replace a systemic approach to understanding customer expectations. This problem is amplified in enterprises where managers each own their own customer relationships, and those customers have widely varying service expectations. In fact, managers can make dangerous assumptions about customer needs based on anecdotal evidence. Additionally, poor communication between managers and customer-facing staff tends to widen the gap between actual expectations and managers’ perceptions, which dilutes the organization’s ability to make customer-centric decisions. Had TargetCo deployed formalized customer and internal feedback mechanisms, management’s understanding of customer needs and expectations could have been better aligned.

Gap II: Standards – Management’s understanding of customer expectations vs. service quality standards

Digging deeper, TargetCo lacked the organizational structure needed to deliver customer satisfaction. Customer feedback indicated that TargetCo’s engineers and customer success staff had deep technical and industry expertise. In fact, they were regarded as among the best in this clinical sector. However, management’s policies mandated TargetCo to utilize a rigid support-ticket system that prevented the organization from effectively triaging urgent issues. Additionally, the ticket system operated agnostically of the differing levels of strategic importance that each customer relationship represented. If customer #1 had ongoing concerns about key integration functionalities, their pain points had to wait until TargetCo’s engineers resolved customer #1000’s issue with the software loading on a mobile device.

Gap III: Delivery – Service quality standards vs. services received by customers

The issues exacerbated by the standards gap ultimately manifest in the delivery gap, or the deviation between intended service quality and services actually rendered to customers. Returning to the support-ticket system, many customers stuck in this inefficient model gave up on getting their issues resolved. Others, if they had the resources, built in-house expertise so they wouldn't need to contact TargetCo again. Even when TargetCo’s engineers and customer success staff addressed customer issues, they often faced higher customer expectations, exacerbated by poor responsiveness. As a result, problem resolution often resulted in poor customer feedback, and TargetCo consistently encountered challenges with service recovery.

On paper, the solution is obvious: ditch the support-ticket system and give key customer relationships more account management support. But this kind of service gap isn't unique. We've seen versions of this problem surface across industries: logistics, precision manufacturing, and beyond. Consider a company preparing for a potential capital event. Any manager or financial advisor worth their salt would highlight key metrics such as historical win rates and revenue growth trends. Behind those metrics are typically operating models that incentivize business development and sales teams to pursue new revenue aggressively. After all, growth is growth. However, this model of indiscriminate top-line growth is fundamentally similar to the rigid support-ticket system: it creates an organization with service standards that must accommodate customer #1000's needs, even if it comes at the expense of customer #1’s satisfaction. If a manager requires more rigorous evidence that poor service quality standards are more prevalent than previously believed, they should divide their organization’s customer base into quartiles and examine the top customer frustrations in the top 25%. If comments like “I know how busy my account manager is,” “I get the sense that the team is stretched pretty thin,” or “it takes me a few days to get a response” emerge from these top customers, the organization is almost certainly mismanaging service quality standards. Analyzing the standards gap is critical to enabling an organization to consistently deliver service quality in line with specified requirements for the right customers.

Gap IV: Communication – Services received by customers vs. communications that shape expectations

TargetCo touted that its software solution offered the most comprehensive and integrated clinical management product in its sector. They marketed seamless connectivity between clinical management and supporting features like accounting, payment processing, vendor management, and invoicing. The reality was that TargetCo’s software had several systemic shortcomings that rendered these integrations extremely difficult to implement, use, and/or maintain. Our analysis of top customers found that many abandoned these features in favor of other makeshift solutions, creating a common perception that TargetCo had exaggerated the software’s capabilities and value proposition. As a result, roughly half of the top 10 customers had intent to explore alternative solutions once their existing agreements expired.

We frequently see this communication gap in companies with poor alignment between sales and operations teams. The two teams tend to have little overlap in functional skills and collaboration throughout the sales cycle. When combined with other shortcomings, such as the standards gap, sales professionals often lack a deep understanding of their operating colleagues’ functional capabilities, constraints, and delivery capacity. Some of the most successful models we have seen – especially in service sectors – demonstrate strong alignment across business development, service execution, and problem resolution. In fact, the most satisfied customers often say the same thing: they have a go-to contact at their service provider who can manage nearly every aspect of the relationship. This is critical for companies with concentrated revenue, where top customers typically have more complex needs. The communication gap is one of the most significant killers of customer loyalty and therefore a key area of management focus when refining an organization’s ability to meet customer expectations.

From countless engagements, we've learned that ambiguity is the single most significant barrier to delivering it. Without systems to validate whether the organization's understanding of customer needs, service standards, and external messaging actually aligns with customer expectations, delivering satisfaction requires either tremendous luck or very patient customers. Unfortunately, our work in commercial diligence has found that both are in exceedingly short supply. As a result, the model of service quality provides a critical structure to managers’ efforts to achieve the universal requirement to survival in a free-market economy: “good” customer service.

Unhappy Customers

50%

Half of TargetCo’s top customers planned to seek alternatives due to unmet expectations and software shortcomings.

How Private Equity Firms Can Win More Deals and Make Them Count With Smarter Commercial Insights

How Private Equity Firms Can Win More Deals and Make Them Count With Smarter Commercial Insights

When AI Gets Market Sizing Wrong: A $33 Billion Reality Check

When AI Gets Market Sizing Wrong: A $33 Billion Reality Check

Market-Driven Innovation vs. Technology-Driven Innovation

Market-Driven Innovation vs. Technology-Driven Innovation

Contact us to see how we can help your business today.

Never miss a beat. Get our latest insights in your inbox.