A Coming PE Surge: A Collaboration with PitchBook

In M&A due diligence, there is a misconception that customer concentration is based solely on individual customer revenue percentages. That is not the case.

Shifting focus to profitability by customer cohorts reveals that only a small portion of customers significantly contribute to EBITDA and cash generation. A strategic focus on profitable customer segments will enhance overall profitability.

Goldfish have a three-second memory (they don’t). You can see The Great Wall of China from space (you can’t). Bats are blind (they aren’t). These misconceptions are so common that they have stealthily woven into our collective beliefs; I, too, had to fact-check.

In our M&A due diligence work, we see a misconception all the time, which if not corrected, can cloud decision-making and threaten success. It is one to which many leaders are unaware: customer concentration only exists if one customer generates a meaningful percent of revenue. Again, false.

I recently submitted a proposal to a private equity client with a lower middle market manufacturing business under a letter of intent. The client wanted to conduct customer due diligence to help underwrite the stability of the revenue base and to help measure price elasticity, as significant post-close price increases were a critical part of the investment thesis.

The client approved the proposal but requested one change before they signed it. And no, it wasn’t lowering the price or shortening the timeline. They asked that the following statement be removed: “The target company has a significantly concentrated customer base.” I obliged, of course, but in passing I asked, “What are you seeing in the data that leads you to believe the customer base is not concentrated?” Their reply was, “Well, it’s simple. No single customer is more than ten percent of revenue.”

We often encounter this. In our experience, most clients tend to define concentration at the individual customer level, be it 5%, 10%, or even 25% of revenue. However, our decades of implementing 80/20-based value creation strategies provide us with a different – and we think more impactful – framework for thinking about concentration.

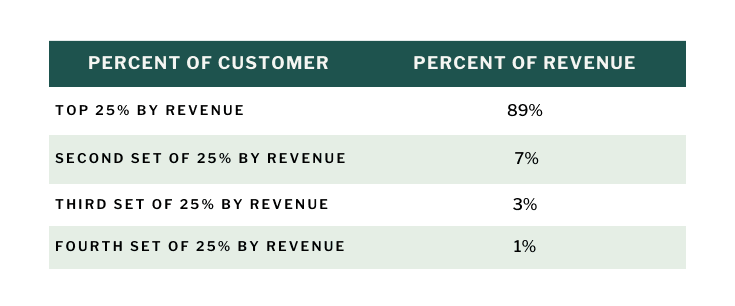

If we were to meet in person and trade business cards, you would see the numbers 89%, 7%, 3%, and 1% on the back. If we ever go golfing together, our Strategex-branded golf balls have 89%, 7%, 3%, and 1% printed on the box. If I’m ever brave enough to get a tattoo, 89%, 7%, 3%, and 1% is a top contender.

We prepare thousands of these quartile analyses every year, and if it is for a mature B2B firm these numbers very rarely deviate more than +/- 5 points, whether it’s an industrials, services, or even software business.

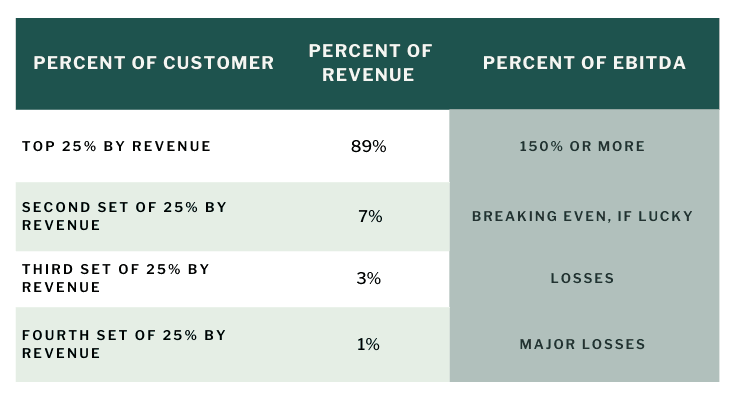

Admittedly, this analysis alone is somewhat trivial. It’s classic 80/20: 20% of customers generate roughly 80% of revenue. But, when we take it a step further and add profitability by quartile, we quickly see this framework is anything but trivial. It’s highly strategic and, for a private equity investor, it makes it very clear that when buying an entire company only a small portion of that company’s customers are generating cash.

In fact, most companies we diligence are about 150% more profitable than their P&Ls would suggest; unfortunately, their profitability is being eroded by a long tail of customers that, from a direct costing perspective, don’t generate enough contribution margin to cover the overhead it takes to service them.

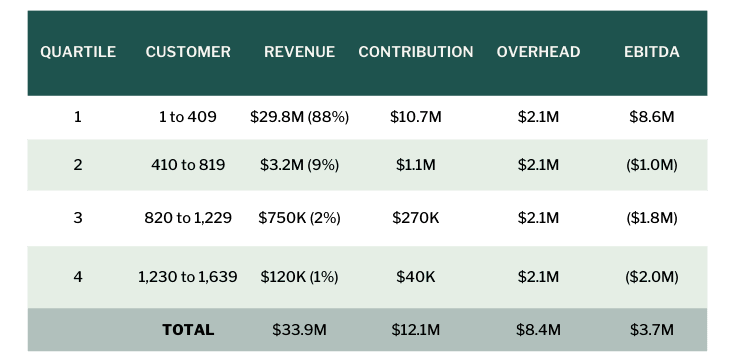

Just as this 80/20 pattern is observed over and over, so is a 5/50 pattern. 5% of customers often generate 50% of revenue and roughly 100% of a company’s EBITDA. Here is some real data for that same manufacturing business that supposedly had no customer concentration:

Now, imagine how you might manage your portfolio differently – or think about an investment opportunity differently – if you shifted the way you think about concentration from a customer basis to a quartile basis and from a revenue basis to an EBITDA basis.

It takes a leap of faith and some managerial accounting, but as generating alpha becomes increasingly reliant on margin expansion, this quartile framework provides investors and operators with an opportunity to rapidly double EBITDA by doing less, not more.

Just more of what matters.

-

EBITDA

5/50

5% of customers often generate 50% of revenue and roughly 100% of a company’s EBITDA.

A Coming PE Surge: A Collaboration with PitchBook

A Coming PE Surge: A Collaboration with PitchBook

Simplification Drives Profitability

Simplification Drives Profitability

You Haven’t Completed M&A Due Diligence Until You Know a Target’s Material Margin

You Haven’t Completed M&A Due Diligence Until You Know a Target’s Material Margin

Contact us to see how we can help your business today.

Never miss a beat. Get our latest insights in your inbox.