Get in touch

Contact us to see how we can help your business today.

Structured earnouts in M&A have become commonplace during Covid. Question is, how do sellers hit financial milestones, triggering the earnout, when the economic cards of volatility and recession are stacked against them?

One noticeable impact of COVID-19 on M&A is the increased usage of earnout clauses in transaction structures. Whereas eight months ago, earnouts – a portion of the sale price only paid to the seller once the business achieves specific financial milestones – were rare, nearly every letter of intent we have reviewed since March has included one.

On paper, it makes sense. There is inherent risk in doing deals in today’s environment and that risk needs to be shared. One major question, however, is how should sellers think about hitting those financial milestones, triggering the earnout, when the economic cards of volatility and recession are stacked against them?

One strategy, while simple, is by no means easy to achieve: radical focus on the drivers of value creation while simplifying parts of the business that are unprofitable.

Fortune 200 manufacturing company, Illinois Tool Works (ITW), was the first to institutionalize this approach and the results speak for themselves. At the peak of ITW’s acquisitiveness, the company was purchasing an average of one business a week. During this stretch, none of ITW’s roughly 200 acquisitions had any impaired goodwill and the company generated a 19% compound annual shareholder return.

How did ITW achieve such remarkable and consistent results, and how can middle-market management teams use the ITW approach to trigger an earnout?

The story begins in 1906 when Italian economist, Vilfredo Pareto, established what is known today as the Pareto Principle, or the 80/20 rule. The 80/20 rule says 20% of the effort generates 80% of the reward. ITW used the 80/20 rule to reinvent the way it assessed concentration risk during due diligence, developing post-close strategies to transform concentration from a weakness to a strength.

The 80/20 rule in the B2B space is pervasive, but too often buyers and management teams think of concentration simply in terms of revenue by customer. What ITW realized is that there is a much more strategic way to think about concentration, and that is by looking at the relationship between customer and product/service concentration.

Why look at it this way? Because low-value customers may still be purchasing high-value products and services. Similarly, low-value products and services may be purchased by high-value customers.

Simply cutting customers or products and services without understanding the dynamic between the two will often do more harm than good. For example, your largest customer may buy your least profitable product, but without that product in the portfolio they establish a relationship with a competitor, risking wallet share.

Imagine if your preferred grocery store sold cereal but stopped selling milk. Despite how loyal you may be to that store, you’re going to the competition on your next grocery run.

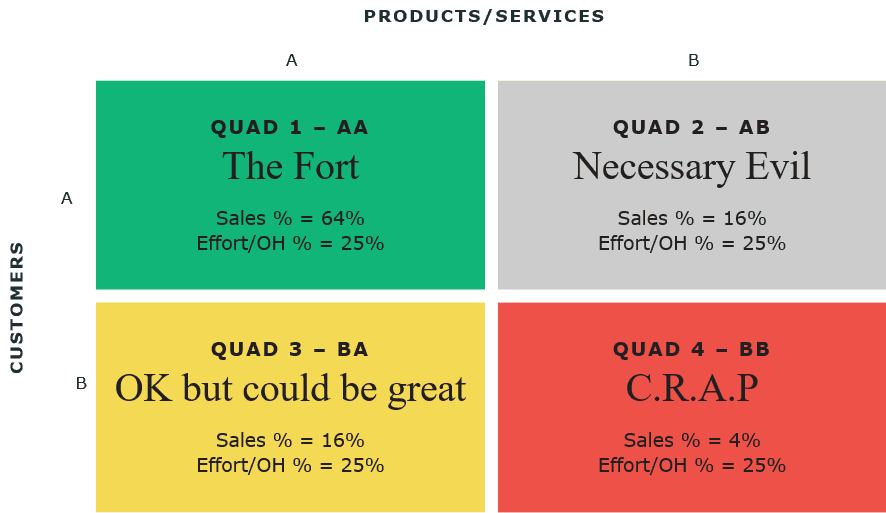

By segmenting their businesses into four quadrants, ITW was able to identify where it was making money and where it was losing money. Armed with these insights, it developed targeted strategies for each segment, which resulted in profitable market share growth.

The Fort, or the highest value customers that purchase the most profitable products/services, typically generates 64% of a business’s revenue and more than half of its profit. After successfully closing a transaction, immediate measures need to be taken to secure these customers. If one customer in The Fort leaves or lowers their spend, the ability to meet financial goals and ultimately trigger the earnout can be compromised.

Strategy: Create “Raving Fans” among top accounts and organically or inorganically acquire new accounts which fall in The Fort.

Tactics: key account management, Net Promoter Score tracking, target selling, strategic add-on acquisitions, a “yes, and” approach to customer service, etc.

Pro Tip: Pre-close, validate how secure The Fort is through customer due diligence.

Next, decide what to do with low-value customers that exclusively buy low-value products/services. Companies simply "Can’t Realize A Profit" in this segment of their customer base. Aside from the lack of profit, this segment often adds hidden costs in the form of spent operating income and distraction from more important things like sustainable growth.

Tough decisions often need to be made in this quadrant, but what’s ultimately good for the long term growth of the business is good for the seller with the chips still on the table.

Strategy: Eliminate this quadrant through customer and product/service line simplification.

Tactics: Price increases, order minimums, carve-out deals, a “yes, but” approach to customer service, etc.

You’re driving down a highway and the car in front of you stalls. What do you do? You change lanes. The same approach applies in this segment (low-value customers buying profitable products/services), which can be extremely profitable if you change lanes and continue to sell to these customers without adding cost to serve them.

Strategy: Keep the most profitable products/services flowing to these customers while reducing the cost of having to directly service these customers.

Tactics: e-commerce, channel optimization, distributor agreements, inside sales, etc.

The fourth and final segment, also known as "The Necessary Evil," is your A customers that buy your B products. Not ideal but often necessary to keep these loyal customers coming back for more. Efforts to simplify this segment need to be handled with care, as the price of poor decision making here is often lost customers.

Strategy: Gradually transition customers to your A products/services and accept the fact that this part of the business will likely always exist.

Tactics: New product development to create better substitutes for your B products/services, tiered commission structures to incentivize your better products/services, price optimization to incentivize your better products/services, etc.

While these strategies and tactics are particularly effective among sellers chasing financial milestones post transaction, they can be just as (if not more) effective when deployed by management teams struggling to profitably grow market share, either during a recession or an expansion.

Interested in learning more? Connect with Anthony Bahr, Managing Director at Strategex.

Connect With Anthony

Connect With AnthonyContact us to see how we can help your business today.

Never miss a beat. Get our latest insights in your inbox.