NPS: Stop Doing It Wrong

To improve the odds of successful SaaS acquisitions, you must analyze more than traditional churn and loyalty metrics.

Even before COVID-19, private investment in software as a service (SaaS) companies was accelerating, both in terms of activity and valuation. Coming out of the pandemic, mission-critical and subscription-based software businesses are likely to become an even more desirable strategy as investors seek recession-resistant platforms anchored by strong recurring revenue and upside potential.

This investment thesis is entirely dependent on a target company’s ability to sustain strong recurring revenue by retaining its customer base, particularly top accounts which often generate a disproportionately high percentage of revenue (we typically observe the top 25% of the customer base generates 89% of revenue). For this reason, it is essential for investors to mitigate customer concentration risk as the loss of a top account has the potential to materially impact EBITDA.

Relying solely on churn to understand the stability of customer relationships is like looking at a flaming car through the rear-view mirror.

Therefore, customer churn is a vital metric for SaaS investors to understand. However, relying solely on churn to understand the stability of customer relationships is like looking at a flaming car through the rear-view mirror. It doesn’t tell us what caused the accident and looking in the past for too long can distract us from threats in our immediate future.

In most B2B sectors, overlaying churn with customer loyalty measurements like the Net Promoter Score (NPS) helps tell a more holistic story. Combined, these two metrics can predict future churn while also identifying specific steps that can be taken to mitigate it post-close.

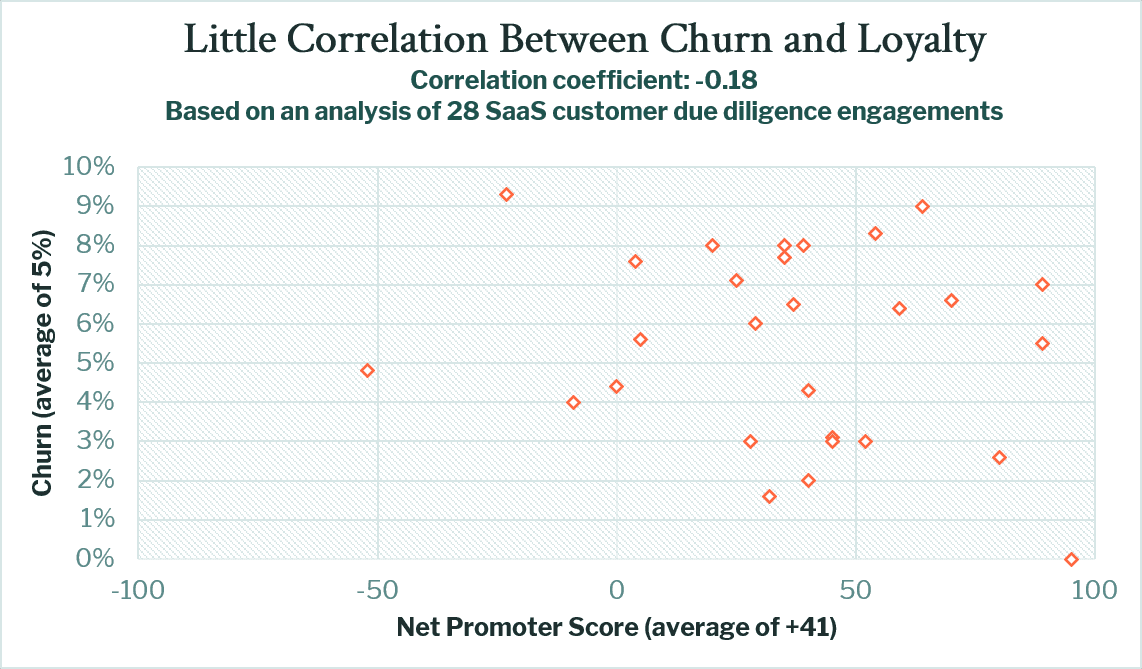

However, in the SaaS space, loyalty has not proven to be a reliable predictor of churn. Across our sample of 28 SaaS customer due diligence engagements, there is a nearly non-existent relationship between these two variables. Why? Because the tremendously high cost and burden of switching SaaS providers have the potential to generate stickiness even in instances where customers are extraordinarily disloyal.

Just like people hanging on to their AOL.com email addresses, simply the thought of switching can outweigh the benefit of switching. Another example: we recently worked on a SaaS transaction where the target company registered a -52 NPS, the worst we have ever observed across hundreds of deals. Still, more than 80% of the customers we interviewed said they were “very likely” to renew their contract at the end of the current term. As one highly dissatisfied customer put it, “Once you get integrated with a technology company it’s hard to break away. Changing technology vendors is very difficult. We've invested a lot of money with them and there are not a lot of companies that can do what they do. It is what it is.”

Just like people hanging on to their AOL.com email addresses, simply the thought of switching can outweigh the benefit of switching.

But as we all know, hope is not a strategy and expecting dissatisfied customers – and the recurring revenue they generate – to be retained throughout the holding period is not good business, especially in a space with both high levels of consolidation and a constant trickle of new competitors.

If NPS isn’t predictive of churn, does that mean it isn’t a valuable tool in the SaaS space? Not at all, it just means we have to dig deeper and broader to understand the drivers of – and barriers to – customer loyalty and lifetime value.

Through the process of engaging in in-depth discussions with decisions makers at a target’s top accounts, insights can be collected to not only help investors validate the investment thesis pre-close, but they also add value well beyond closing since management teams have the feedback to start building relationships that are sticky both out of necessity but also by choice.

-

Anthony Bahr is Managing Director of our Customer Due Diligence practice. When he's not advising private equity clients on customer risk, he guest lectures on consumer behavior and research methodologies at Cornell University, Loyola University Chicago, and the University of Pennsylvania.

If you'd like to learn more about our Customer Insights or 80/20 methodologies, please contact us. We make it look easy, but caution: don't try this alone.

Message Anthony

Message Anthony

Average Deal Savings

$21M

*When we uncover issues

Related Content

How do you know your acquisition target has the secure customer base they claim? You conduct Customer Due Diligence research with Strategex. We've got 30+ years of experience researching and analyzing customers. And, we support $6B in transactions every year.

NPS: Stop Doing It Wrong

NPS: Stop Doing It Wrong

Delivering a Digital CX for Top Accounts

Delivering a Digital CX for Top Accounts

How a Private Equity Firm Saved an Easy $6M

How a Private Equity Firm Saved an Easy $6M

Contact us to see how we can help your business today.

Never miss a beat. Get our latest insights in your inbox.