NPS: Stop Doing It Wrong

Net Promoter Score (NPS) by itself is no better than a beauty contest.

The overuse of NPS – where every transaction with a company is followed by a web or robocall, is a waste of time and money. Response rates dip into the low single digits. Respondents are more likely to rate an interaction if they had a poor experience. The ability to completely ‘wow’ a consumer or customer in today’s jaded world of customer experience – PLUS have them take the time to respond to a web or voice-survey – is nearly impossible.

When B2B companies follow the same route as the over-surveyed B2C NPS route, they’re destined to have the same results. Mediocre at best.

The most effective use of NPS is as one component of a larger relationship measurement assessment. NPS ratings should be included, but it's essential to add ratings and rank for performance and preference. I can't over-emphasize the value of rank – what is the company’s rank for preference compared to other competitors the customer works with? How well does the company engage – proactively, consistently, with meaningful meeting content?

Customer Experience performance indicators including Engagement, Rank, and NPS have a high degree of correlation. The key point: NPS is only one leg of a three-legged stool. Each one, by itself, does little – but combined they become a powerful measurement – and predictor – of human behavior.

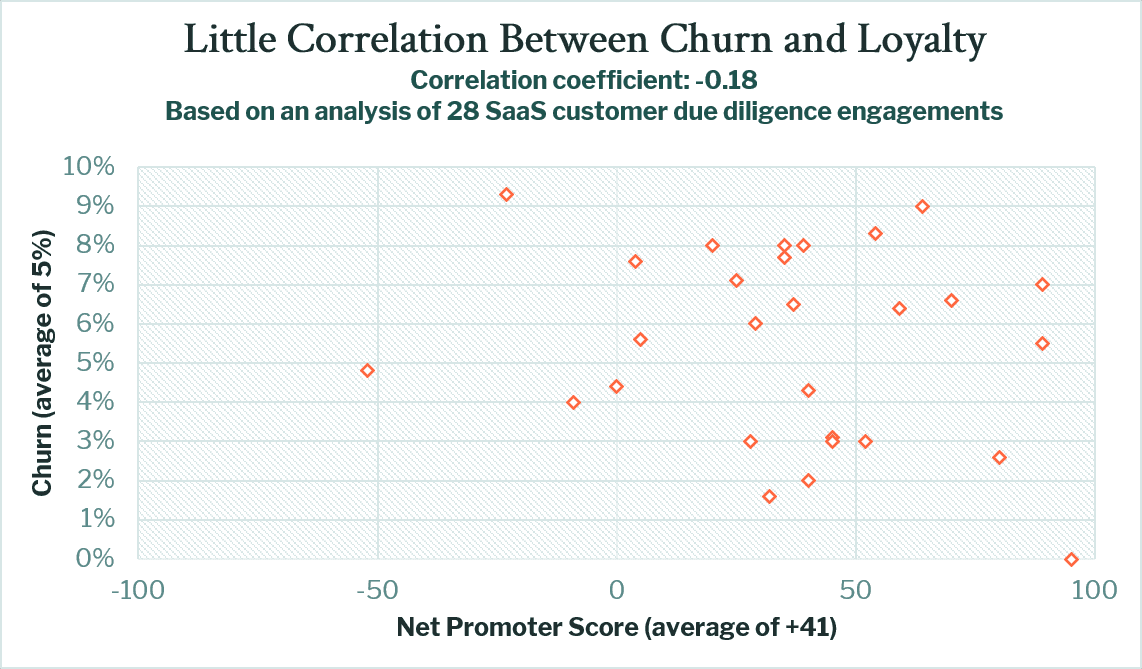

Expecting that NPS alone can predict churn is wrong

In most B2B sectors, overlaying churn with customer loyalty measurements like the Net Promoter Score (NPS) helps tell a more holistic story. However, expecting that NPS alone can predict churn is wrong. You need more information; you need qualitative data. To truly understand churn, you must execute one-on-one in-depth interviews. Use NPS as one component – with the follow-on question: "Why?" Understanding the why behind the score is more vital than the score itself. After all, predicting churn is valuable – preventing churn is magical.

Combined, these NPS and qualitative CX insights can predict future churn while also identifying specific steps that can be taken to mitigate it.

Case in point, we recently analyzed the relationship between churn and loyalty in the Software as a Service (SaaS) space. In the SaaS space, loyalty has not proven to be a reliable predictor of churn. Across our sample of 28 SaaS customer insights engagements, there is a nearly non-existent relationship between these two variables. Why? Because of the tremendously high cost and burden of switching providers have the potential to generate stickiness even in instances where customers are extraordinarily disloyal.

To truly measure customer satisfaction, invest the time in interviewing your most valuable customers. Customers appreciate being interviewed and dislike being surveyed. The fact that a company will take the time and energy to ask their opinions speaks volumes about its importance. The power of the in-depth interviewing process is a deep level of customer understanding that you will never get from an NPS score.

NPS is only valuable if there’s a depth of content and context about the overall relationship – the full customer experience.

The author, Kay Cruse, is Vice President of Customer Experience at Strategex.

Contact Kay

Contact Kay

Related Content

Your focus is on providing a seamless customer experience to drive profits, loyalty, customer success, and to increase the value of your brand. But do you know who your most valuable customers are? It's not always the loudest voice, or the one most willing to give feedback.

NPS: Stop Doing It Wrong

NPS: Stop Doing It Wrong

The Hierarchy of Customer Needs, Explained

The Hierarchy of Customer Needs, Explained

Preparing the Customer Experience for a Post-Pandemic Economy

Preparing the Customer Experience for a Post-Pandemic Economy

Strategex has assembled a team of world-class business leaders, analysts, and researchers. Our talent includes experts who were active in the genesis of 80/20 as a foundation for operational excellence, disruptors of due diligence, and consultants who have practiced customer experience since before it was coined "customer experience."

Contact us to see how we can help your business today.

Never miss a beat. Get our latest insights in your inbox.