How a Private Equity Firm Saved an Easy $6M

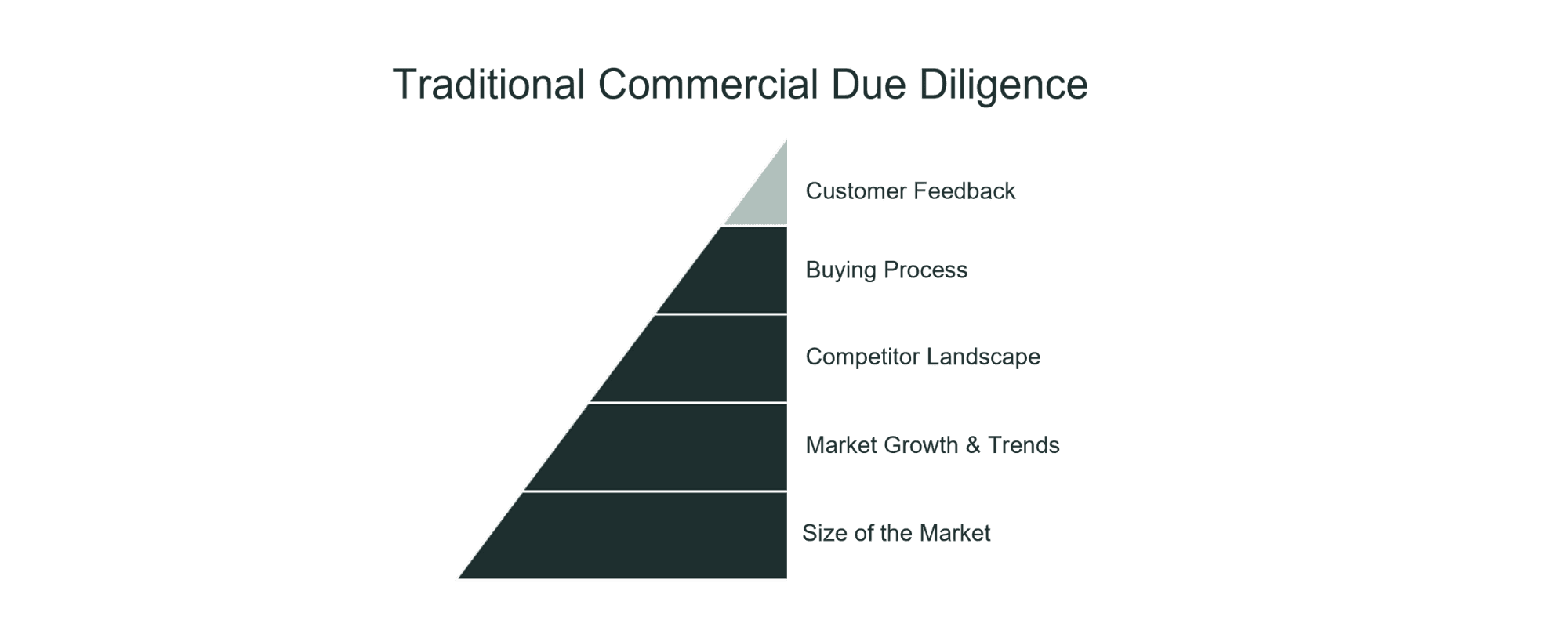

It’s no surprise that the most successful investors start thinking about strategies to accelerate growth well before they close a deal. Conducting comprehensive commercial due diligence to better understand the landscape in which a target is operating is one way to do this, but it tends to miss the tactical, customer-specific opportunities to quickly gain wallet share and sustain price increases.

It’s no surprise that the most successful investors start thinking about strategies to accelerate growth well before they close a deal. Conducting comprehensive commercial due diligence to better understand the landscape in which a target is operating is one way to do this. But, it tends to miss the tactical, customer-specific opportunities to quickly gain wallet share and sustain price increases.

While some commercial due diligence engagements include direct customer feedback, it often takes a backseat to more macro data points and trends such as market sizing, competitive landscape, etc.

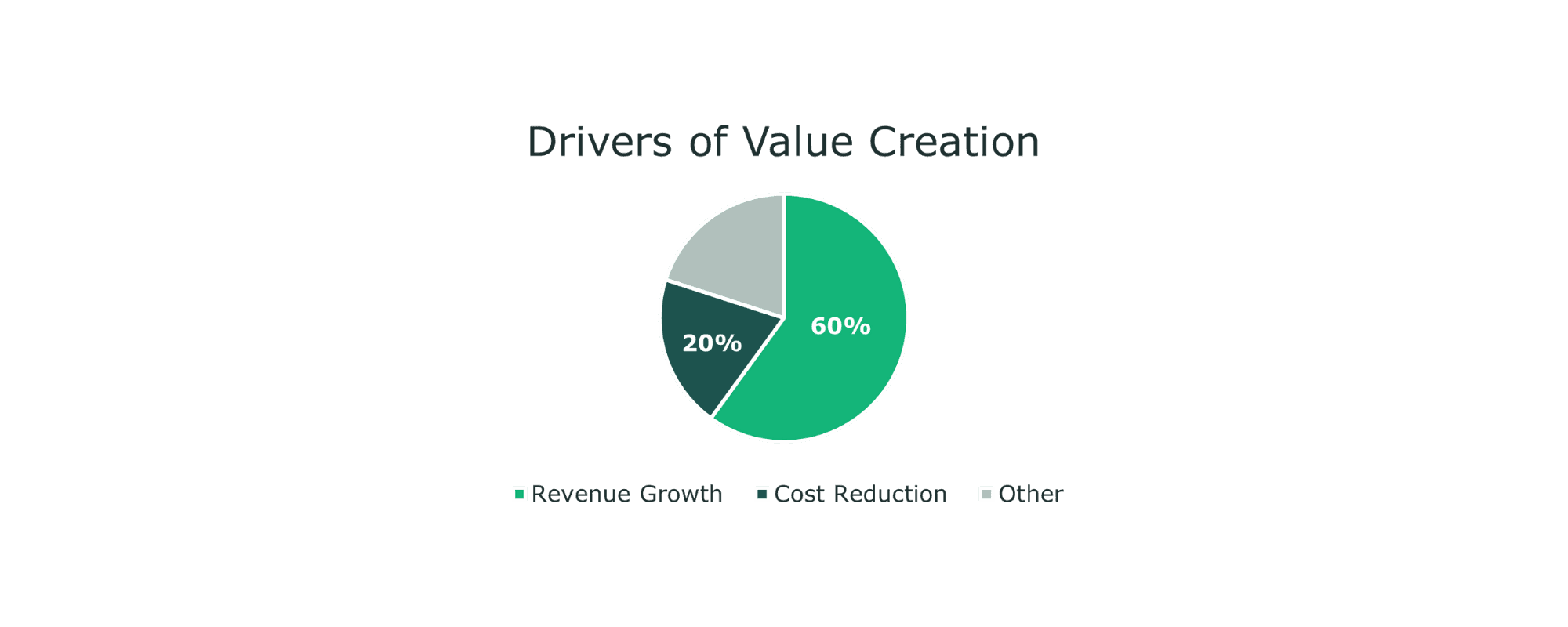

In reality, every investor and management team knows that the strength of the relationship between customer and company is, in most instances, the primary driver of a company’s value creation potential.

Rob Ospalik, Partner and Co-Head of Global Operations at Baird Capital , knows this is true. “On the front end, insights into customer relations is in many ways the most important thing that we want to understand about a company that we’re investing in. The value is created at the customer relationship.”

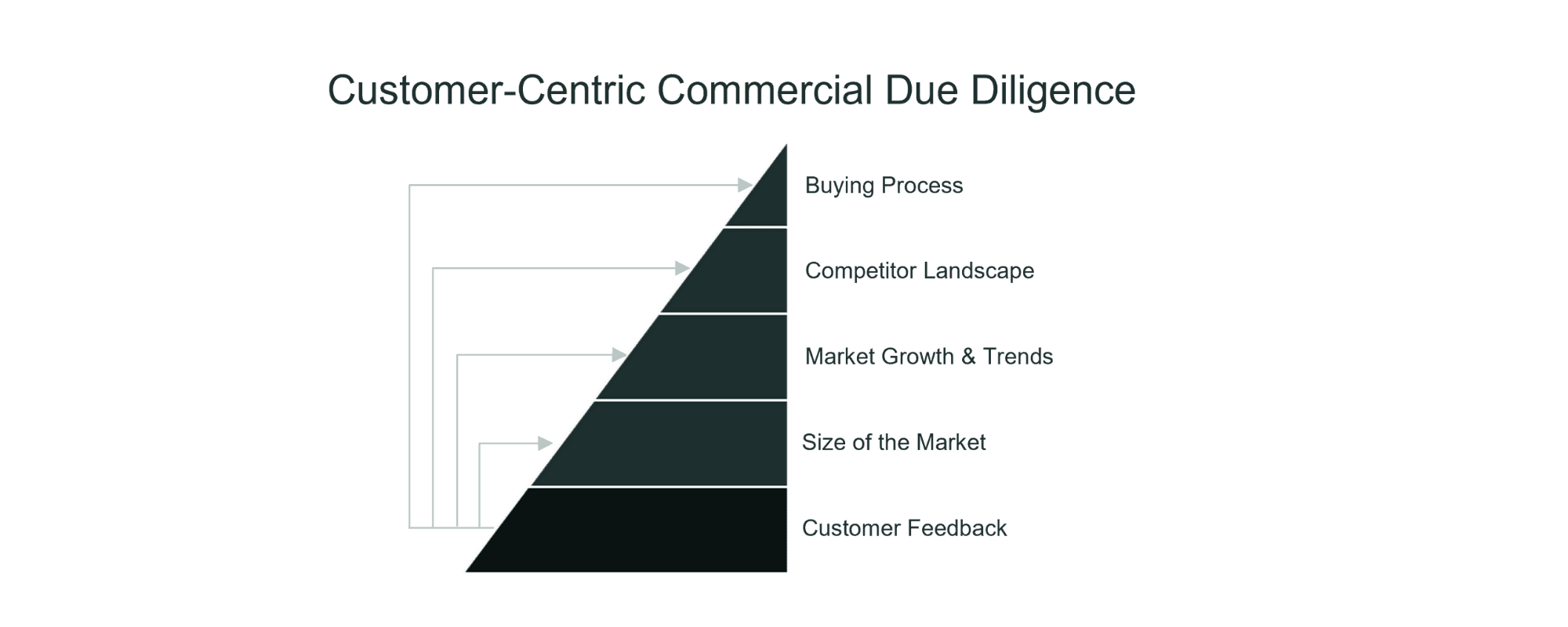

Therefore customer feedback must be the foundation of commercial due diligence, not an afterthought. And, when done properly, customer due diligence will provide insights to many -- if not all -- of the same objectives as commercial due diligence, with the added benefit of the first-hand perspective of your future customers.

Most investors already collect some form of customer insights pre-close, be it through CRM analytics, online satisfaction surveys, or review sites, etc. However, too often these initiatives are treated as cursory reference checks. When investors approach customer due diligence in this way, they miss an opportunity to uncover meaningful insights that can be used to mitigate risk and accelerate post-close growth.

Fortunately, there is a better way. Customer due diligence designed around the Voice of the Customer methodology and the 80/20 rule generates pragmatic insights that investors can use to close with confidence, while also providing management teams with Day One recommendations to kickstart growth.

It starts with identifying key revenue generators through a quartile analysis, then conducting thorough interviews with decision-makers at those key accounts. These conversations are designed to validate the investment thesis and often include objectives such as:

In multiple cases, we’ve seen customer due diligence greatly impacts the trajectory of a deal. For example, one of our private equity clients was recently looking to acquire an LED lighting manufacturer. However, over 50% of top accounts complained of late deliveries and poor service. “There’s nothing I like about them,” said one customer. We also found that competitors were greatly preferred and very likely to win any future business. Consequently, our client withdrew their offer and saved themselves from writing a $21 million equity check.

In another case, customer due diligence helped create a focused and effective integration plan. The target, in this case, was in the automotive industry, and customer insights helped the management team identify engineering priorities that needed to be addressed to increase sales. As a result, the investor was able to isolate immediate synergies and product improvements as critical components of the integration, and the company realized 300 BPS in operating income improvement in the first 100 days post-close.

When you invest in a company, you are essentially investing in customer relationships which, in turn, generate revenue, profit. While commercial diligence is grounded in data, we sometimes forget to include the most predictive data point of all – the voice of the customer.

-

Customer Due Diligence Impact

$21M

A CDD client saved millions as a result.

Related Content

How do you know your acquisition target has the secure customer base they claim? You conduct Customer Due Diligence research with Strategex. We've got 30+ years of experience researching and analyzing customers. And, we support $6B in transactions every year.

How a Private Equity Firm Saved an Easy $6M

How a Private Equity Firm Saved an Easy $6M

Analyzing Churn During SaaS Due Diligence

Analyzing Churn During SaaS Due Diligence

The New Age of Risk, Diligence, & Growth

The New Age of Risk, Diligence, & Growth

Contact us to see how we can help your business today.

Never miss a beat. Get our latest insights in your inbox.